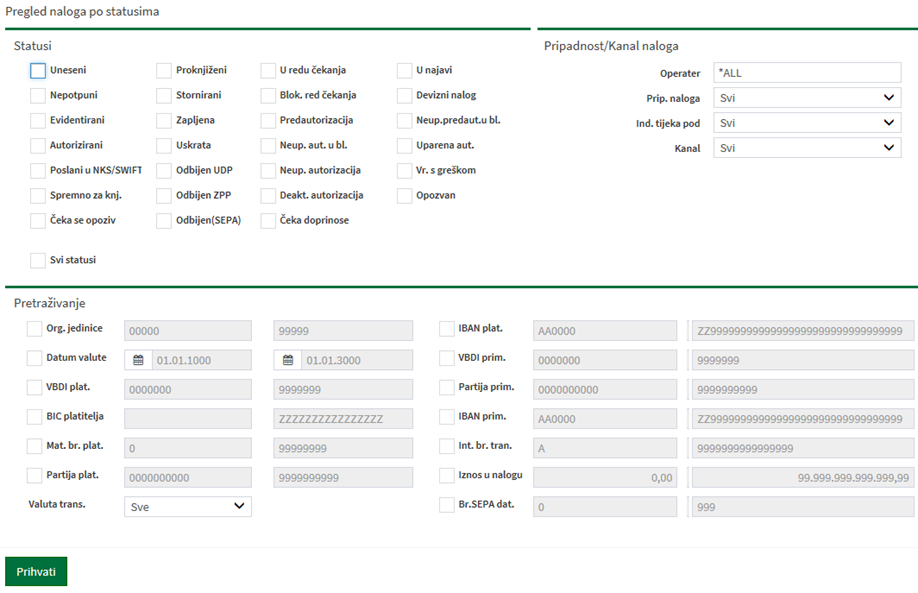

CoreBank supports payments and exchange of data, messages and transactions with sub-systems of international and domestic payments including Instant Payments, and clearing organizations through connectivity with the SEPA, SWIFT, Target2, National Clearing System, Real Time Gross Settlement System and local financial agencies. You can benefit from our 20+ years of Payments experience and expertise incorporated into our mission-critical solutions.

All transactions are carried out with minimal data entry, as the calculation of fees, taxes, local currency equivalents, currency conversions, foreign exchange differentials and similar are fully automated and parameterized. The CoreBank Payments module highlights:

- Processing high volumes of payment orders (SCT, SDD, SIP, non-SEPA, SWIFT, Target...)

- Monitoring of the bank’s and client’s liquidity

- Automatic process of blocking/unblocking of clients/accounts

- Tracking of future payment orders

- Recording of legal basis for payments

- Managing payments priority

- Automatic calculations of taxes, fees and interests

- Data exchange with specific formats of large payment systems and networks (including SEPA Batch Booking)

- PSD2 API, PSD2 Payments, SCA (Strong Client Authentication)

- SEPA Instant Payments, 24/7 SIP possible even with bank's core system which is not 24/7

- ISO 2022 support

- Support in Cloud or on-premise servers, REST API supported