Accounting

Any transaction, regardless of the place of its origination, is automatically posted to the General Ledger without any additional input requirements. The CoreBank accounting module ensures transparency of all transactions at any point within the system, which is the main precondition for accurate and up-to-date balance sheets.

Double-entry accounting is applied to every booking order entering the general ledger.

General ledger and various sub-ledgers were designed to support wide spectrum of banking services and to facilitate implementation and monitoring of profit centers, thus enabling the bank to monitor profit and loss account by its profit-generating units. At the same time, all internal reports, reports for the banking group and reports to the Central Bank can be prepared at the bank level. Accounting module highlights:

- Input in original currencies and monitoring of transactions by different currencies

- Automated calculation of exchange rate differentials, fees and taxes

- Integrated sub-ledger and foreign exchange accounting

- High degree of up-to-date account balance and status

- Profit centers supported

- P&L by client and by banking product

Commission business activities (for others).

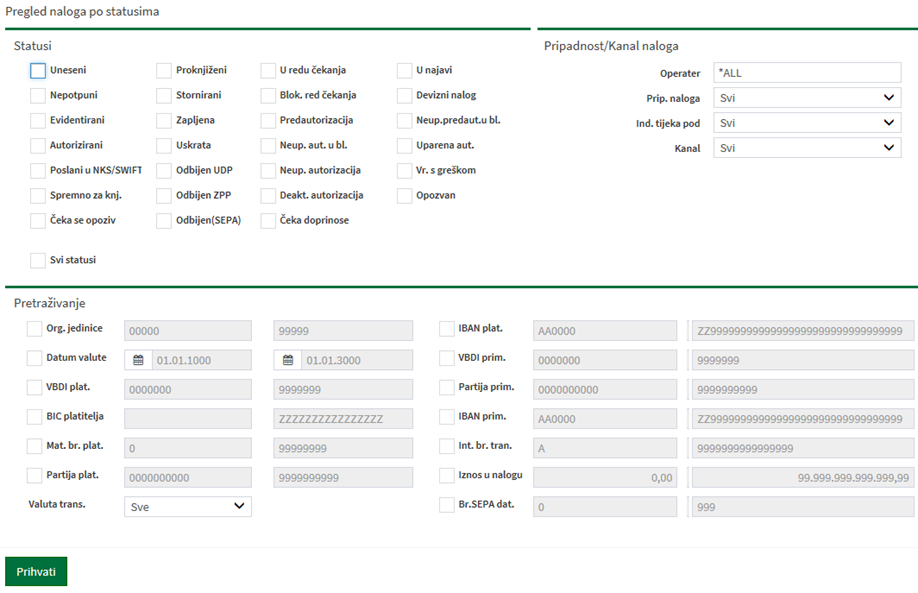

Reports ![]()

Integral system design enables creation of a series of reports relevant for the banking

business by AnalyticBank module. Instant availability of up to date reports regardless of transaction’s entry point makes such information available to specialists and management for timely and accurate business and decision making. Reporting system highlights:

- Full Central Bank reporting requirements (including BASEL requirements)

- Customizable access to reports

- Ability to create reports on/for any given business date

- Support for a number of standard and special reports (review of card account balances, trial balance, accounting entries and journals, balance sheet, income statement)

- Report generator module, enabling generating reports based on user specifications

- Strong basis for Data Warehouse (DWH) and Business Intelligence (BI) usage

- Fund Transfer Pricing (FTP) – methodology for fund transfer pricing (margin calculations, opportunity rates, regulatory expenses, etc.)

- Controlling module for Controlling department helping coping with increasing IT solution complexity in banks