Solutions

- Banksoft

- Solutions

Digital CoreBank

Core banking solution in SaaS-Cloud concept tailored for fully digital banks without "brick&mortar" branches. We provide fully outsourced multi-tenant, multi-language, cloud solution running on top quality fault-tollerant IT platforms in data centers provided with reliable and trusted partners. This way our clients have benefits of latest technologies and concepts merged with our extensive banking products offering, proven track record and experience with banks and other financial institutions. This includes cloud-based Web, tablet and mobile solutions for microfinance institutions as a fast growing segment of financial industry.

Pricing model for the solution can be institution-based or user-based or transaction-based or a combination of mentioned models tailored for specific needs and business goals.

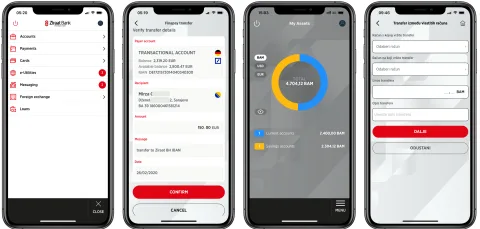

Mobile banking & Mobile wallet

After introduction of Internet banking banks started to offer banking services via SMS messages where clients could see account balances and transactions. As mobile phone (cell phone) industry is one of fastest growing, banks quickly recognized mobile phone as even wider spread user channel than computers. Today, by implementing solutions like our MobileBank module (for Android (including Huawei variant) and iOS operating systems), banks facilitate personal, modern, simple and safe way for their marketing and launching new products and services to ensure highest level of satisfaction, efficiency and loyalty for their clients. Mobile phone at the center of digital life became also a financial tool for paying bills (automatic Scan & Pay with 2D code, SWIFT, SEPA, Instant Payments, Visa Direct), checking transactions and balances with all acounts or searching for closest ATM no mater where you are.

Competition on the banking market is pushing banks every day to innovation and mobile phone (cell phone) is successfully taking a part of banking business previously done in branches, via Internet or with cards and cash. We are proud to announce that we have experience in providing solutions to some of most advanced banks in digital banking and mobile wallets arena.

MobileBank product brochure request

GDPR compliance solutions - managing customer consents including from digital channels, "deleting", anonymization and encryption of customer data according to GDPR requirements for ptivate clients.

In partnership with Strands Finance, spf.strands.com leading Personal Finance Management solutions provider we integrated our awarded modules MobileBank and Strands Mobile PFM to provide full richness of latest-technology on-line banking from transaction-based mobile banking to sophisticated personal finance management and financial planner, available on Android and iOS smartphones and tablets.

Cloud modules

With our extensive experience with APIs and multi-platform on-prem solutions, we provide selected modules in cloud environments that can be easily incorporated into your existing solutions portfolio.

For example Payments modules for SEPA, SWIFT, Target2, Standing orders, AML, which all support latest standards and requirements by EU banking regulations.

Mobile Token

Mobile devices tokens use a mobile computing device such as a smart phone or tablet computer as the authentication device. As typical electronic banking users have their mobile phone with them almost all the time, this solution provides secure two-factor authentication that does not require the user to carry around an additional physical device. With such solution the bank and their clients are saving on operational expenses while increasing convenience and simplicity for electronic banking services that are gaining popularity every day.

Solution is platform-independant on the server and supports leading smartphones and tablets on the market.

Private clients banking

A wide spectrum of banking products and transactions for private clients is supported by CoreBank. Making and keeping your customers happy and recognizing that your bank is providing them top-class services and partnership they can trust and rely on, is our common and ultimate goal. As a result of reliability and high efficiency of CoreBank system it is easier for the bank to gain customer loyalty and recommendations for your banking quality services.

Private clients banking highlights:

- Quick, complete and high-quality client service at every workstation

- Automatic processing of loans and deposits

- Easy cashier management and settlement

- Integrated credit card and debit card processing

- Credit risk management

- Managing client segmentation

- Collateral entry and management module

- Safe boxes

- Buy Now Pay Later (BNPL), merchant or user-initiated automated splitting of transaction into installments during or after making

GDPR compliance solutions - managing customer consents, "deleting", anonymization and encryption of customer data according to GDPR requirements

Corporate clients banking

Flexibility and ability to offer personalized services at the right time, responding to the needs of clients is not only a goal for banks but also an imperative in today’s competitive corporate market. The CoreBank system provides richness in supporting corporate clients in terms of flexibility in the process of granting loans, taking deposits, varying fees and interest rates, issuing guarantees or letters of credit.

The BSA corporate banking module facilitates:

- Full support of local and foreign currency accounts including card issuing

- Managing of blocked accounts

- Adjustment of credit and guarantee models to meet clients’ requirements

- Automated processing of loans and deposits

- Monitoring of credit risk exposure on a client-by-client basis

- Managing client segmentation

- Collateral entry and management module

- Safe boxes for corporate clients

Internet banking

As a foundation of non-stop availability for your clients you can use advantages of our InternetBank module. With optimal investment ensure your clients forget the stress of banking working hours and queuing in bank branches and post offices. Facilitate more transactions by offering your clients atmosphere and comfort of their office or home. They will have more free time to spend with their friends and family or do something else instead of waiting in a queue.

InternetBank solution will not only enable your bank to be always available (on-line) to your clients but it will enable you to offer wide range of secure transactions from their offices or homes.

This solution also contributes to cost control, as opening of branches as well as hiring of new personnel and purchase of additional equipment will not be required while your market share will increase.

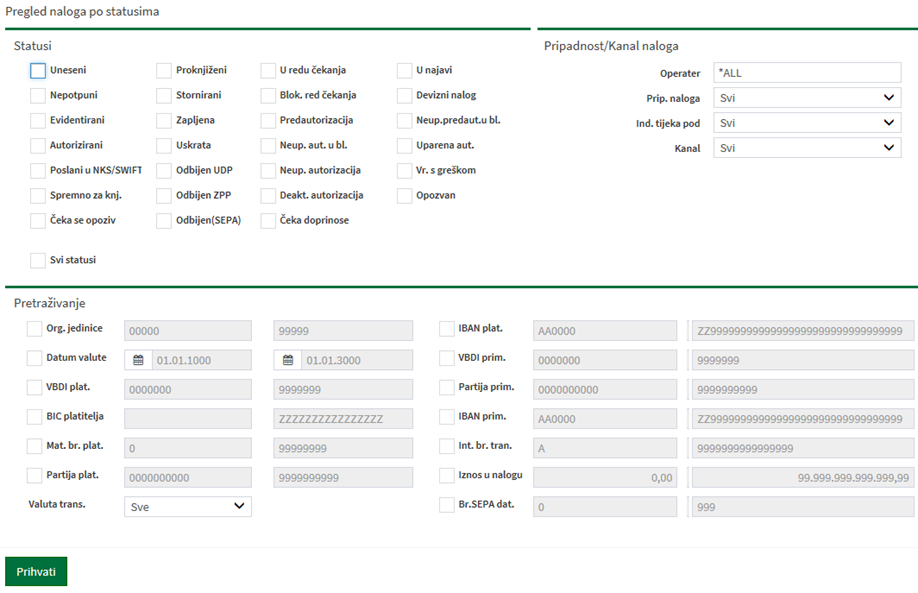

Payments

CoreBank supports payments and exchange of data, messages and transactions with sub-systems of international and domestic payments including Instant Payments, and clearing organizations through connectivity with the SEPA, SWIFT, Target2, National Clearing System, Real Time Gross Settlement System and local financial agencies. You can benefit from our 20+ years of Payments experience and expertise incorporated into our mission-critical solutions.

All transactions are carried out with minimal data entry, as the calculation of fees, taxes, local currency equivalents, currency conversions, foreign exchange differentials and similar are fully automated and parameterized. The CoreBank Payments module highlights:

- Processing high volumes of payment orders (SCT, SDD, SIP, non-SEPA, SWIFT, Target...)

- Monitoring of the bank’s and client’s liquidity

- Automatic process of blocking/unblocking of clients/accounts

- Tracking of future payment orders

- Recording of legal basis for payments

- Managing payments priority

- Automatic calculations of taxes, fees and interests

- Data exchange with specific formats of large payment systems and networks (including SEPA Batch Booking)

- PSD2 API, PSD2 Payments, SCA (Strong Client Authentication)

- SEPA Instant Payments, 24/7 SIP possible even with bank's core system which is not 24/7

- ISO 2022 support

- Support in Cloud or on-premise servers, REST API supported

Decision support & Regulatory reporting

Updated and well designed relational database is ideal source for various views, reports, analysis and at the end for banking decisions. Complex programs in AnalyticBank module are analyzing data, scoring clients and their activities, showing client relationships and profitability, products or services profitability as well as generating various periodic reports. CoreBank’s integral and comprehensive concept is enabling high-quality decision support with following highlights:

- P&L calculation by branch, product and client

- Managing cash-flow

- Interest margins calculations

- Credit risk

- Consolidated reporting for international banking groups

Accounting and Reports

Accounting

Any transaction, regardless of the place of its origination, is automatically posted to the General Ledger without any additional input requirements. The CoreBank accounting module ensures transparency of all transactions at any point within the system, which is the main precondition for accurate and up-to-date balance sheets.

Double-entry accounting is applied to every booking order entering the general ledger.

General ledger and various sub-ledgers were designed to support wide spectrum of banking services and to facilitate implementation and monitoring of profit centers, thus enabling the bank to monitor profit and loss account by its profit-generating units. At the same time, all internal reports, reports for the banking group and reports to the Central Bank can be prepared at the bank level. Accounting module highlights:

- Input in original currencies and monitoring of transactions by different currencies

- Automated calculation of exchange rate differentials, fees and taxes

- Integrated sub-ledger and foreign exchange accounting

- High degree of up-to-date account balance and status

- Profit centers supported

- P&L by client and by banking product

Commission business activities (for others).

Reports ![]()

Integral system design enables creation of a series of reports relevant for the banking

business by AnalyticBank module. Instant availability of up to date reports regardless of transaction’s entry point makes such information available to specialists and management for timely and accurate business and decision making. Reporting system highlights:

- Full Central Bank reporting requirements (including BASEL requirements)

- Customizable access to reports

- Ability to create reports on/for any given business date

- Support for a number of standard and special reports (review of card account balances, trial balance, accounting entries and journals, balance sheet, income statement)

- Report generator module, enabling generating reports based on user specifications

- Strong basis for Data Warehouse (DWH) and Business Intelligence (BI) usage

- Fund Transfer Pricing (FTP) – methodology for fund transfer pricing (margin calculations, opportunity rates, regulatory expenses, etc.)

- Controlling module for Controlling department helping coping with increasing IT solution complexity in banks

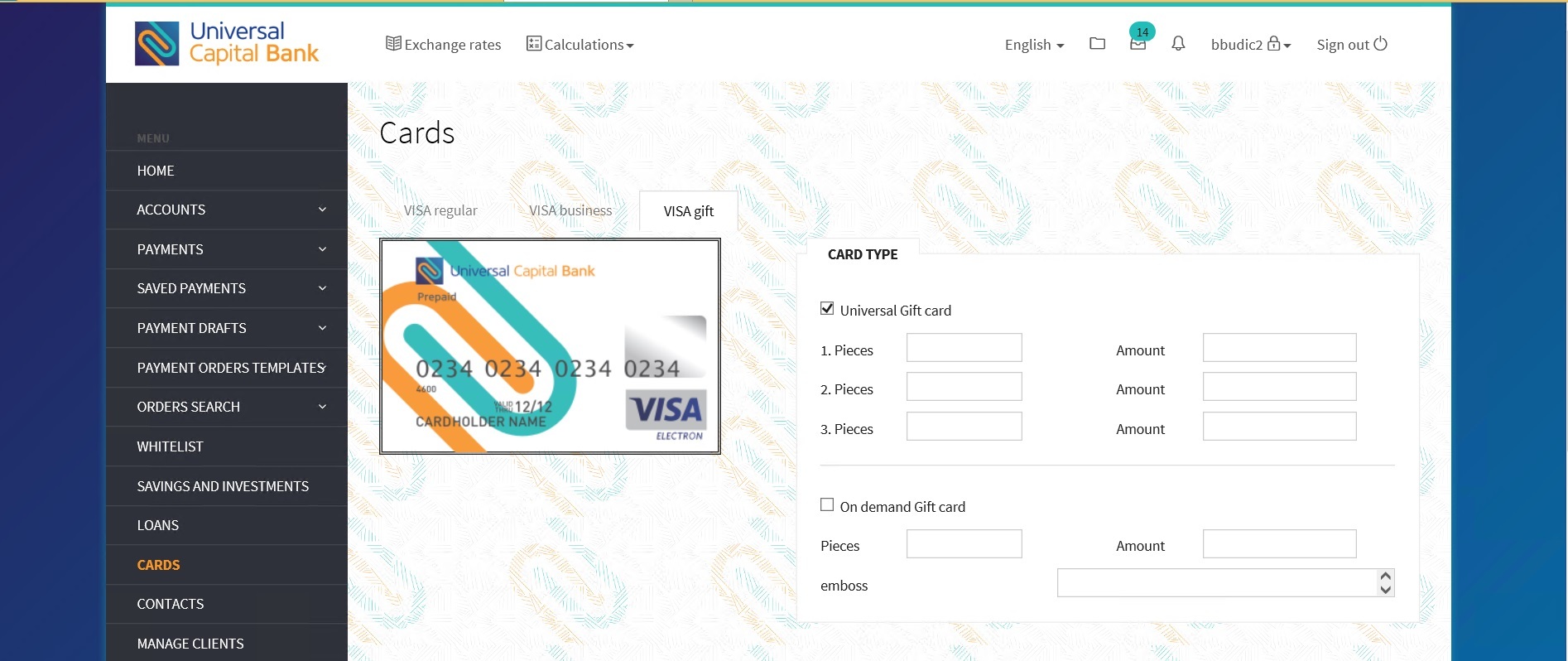

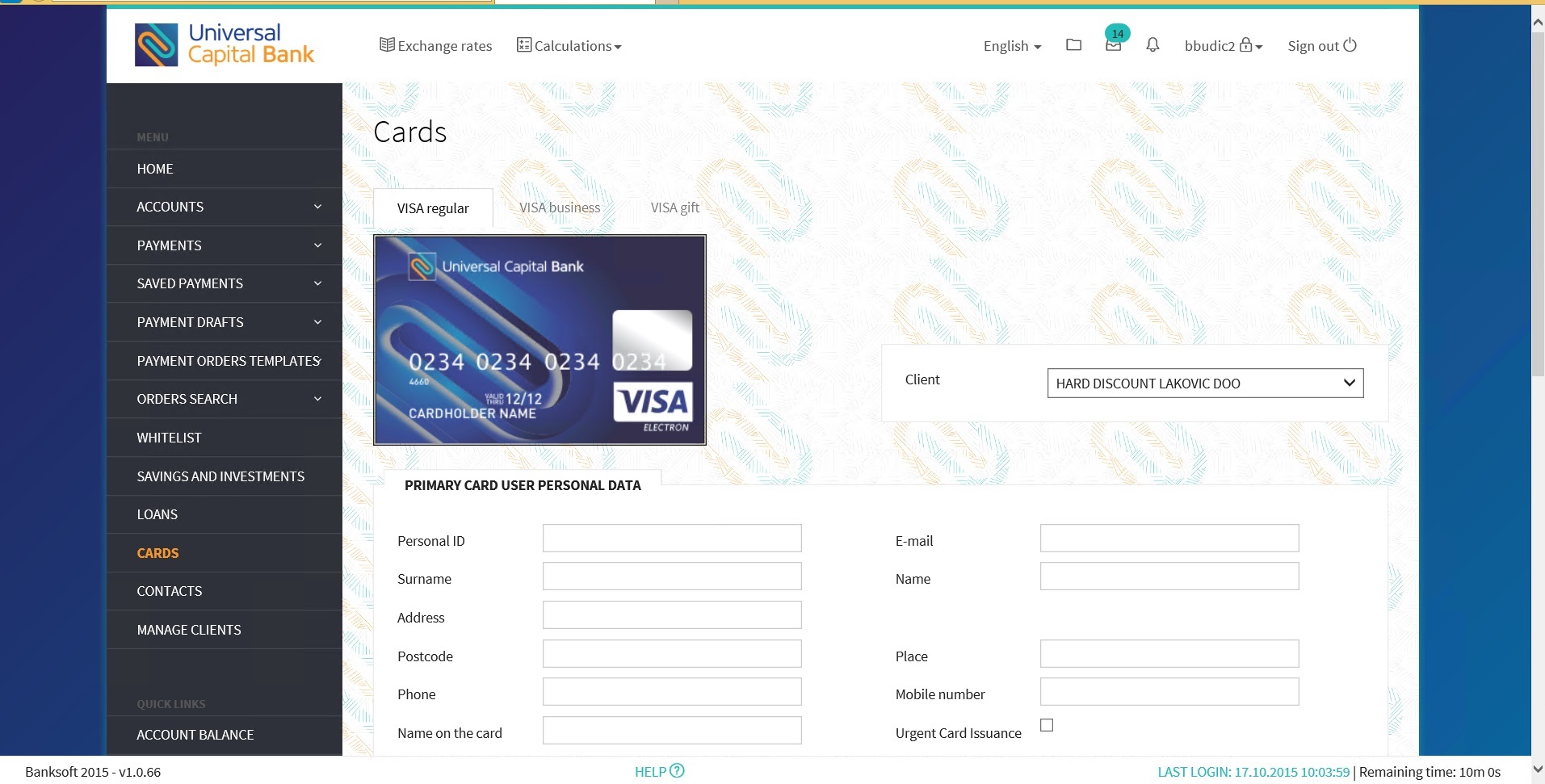

Card management

With current consumer shopping culture cards significantly replaced cash and it is a must for a bank to offer debit, credit or other cards issuing to their clients. With lot of compliance and security rules in card processing business it is very important to fulfill those customer needs with optimal cost and quality. Our CardBank module ensures that bank with minimal investment provides full spectrum of cards (debit, credit, revolving, business...) for its clients ensuring shopping convenience, relationship growth and their loyalty.

- Support for debit, revolving and credit cards, retail and corporate

- Visa Direct support

- Issuance of Maestro, MasterCard or Visa card

- ATMs and EFTPOS devices network support, acceptance of own and others' cards

- Easy and quick implementation, integrations to other systems, experience

- Full control, integration with core system

- A large set of already existing possibilities of parameterization in all elements of the product (fees, card limits, accounting, statements...)

Business Process Management

BPMBank module for banking Business Process Management (BPM) is based on open source Activiti BPM tool and interface to core banking systems or other systems for retrieving or processing account data, transactions, credit worthiness, outstanding debts etc. This module can be adjusted to use also other standard BPM tools that bank may prefer.

Business processes are being set up with defining initiating task and for every task it’s preceding and following task for each business segment that needs to be automated and/or documented and managed. User can independently define and change conditions for previous task completion or next task or tasks initiation within specific business process flow with possibility to set up deadlines and notifications for task completion. From the data collected during task management by various process participants, various reports can be created to show average task processing times, bottlenecks or critical tasks for specific business process, etc.

Well-defined and set up business process flow allows more or less flexibility during process performance, depending on bank’s preference, and provides easier and more transparent bank management and quality management towards banking clients as well as making business more transparent with internal, external and regulatory audits made quicker and easier.

Examples of our business modules based on BPM:

- Loan request processing and management – for private and corporate clients

- Collections – for private and corporate clients

- Risk management – risk recording, risk evaluation, risk management

Any other business segment that bank wishes to cover with BPM methodology can be managed. More info on: sales@banksoft.eu